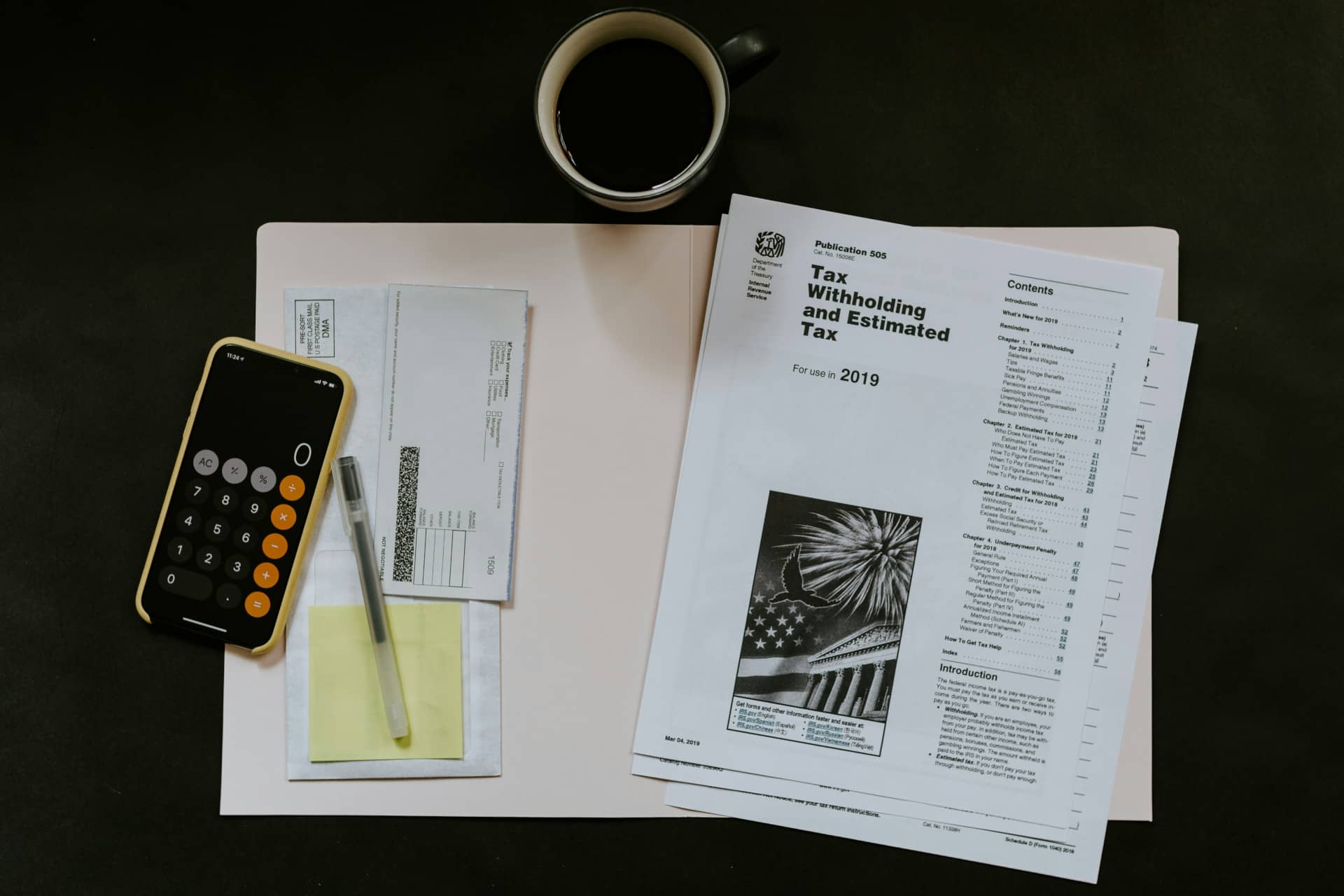

Best Practices

Expert guidance on VAT & GST compliance, strategy, and SAP tax operations

This section brings together expert insights on VAT and GST to help organizations strengthen compliance, improve operational efficiency, and manage risk. Key focus areas include regulatory developments, governance and control frameworks, SAP-enabled tax processes, and strategies for maximizing the effectiveness of VAT/GST operations across jurisdictions.

Strategies for Maximizing the Effectiveness of Your VAT/GST Operations

Explore practical and strategic approaches to improving VAT/GST processes, including governance models, automation, SAP optimization, and data-driven controls that support sustainable compliance and operational excellence.